Goliath vs. Goliath

Apple battle helps Samsung realize hidden strengths

Looking back at the patent battle lasting more than a year on multiple fronts across the globe, it noticeable that Samsung is no longer what it was ― a hardware driven multinational that relied on orders from Apple and other big firms.

It has undergone compressed growth, now going toe to toe with what some still believe to be the world’s most innovative technology firm. Of course, it remains to be seen whether the Korean firm’s sense of confidence can last.

Samsung is not fighting to reduce the size of a $1.05 billion verdict in favor of Apple in a U.S. federal court in San Jose, Calif., but rather its pride. Samsung officials say that it can pay the penalty for patent violations, if the verdict is supported by Judge Lucy Koh.

It is a declaration of its independence that Apple is trying to ignore that is upsetting Samsung.

This is why the Korean company cannot take a step back.

Samsung officials and sources stress that its top management has reached a consensus that Apple is no longer the serious business partner it was a few years ago.

As a top parts supplier for almost all Apple products, Samsung is in a strategic position to hit the American firm where it hurts, they said.

“It’s too sensitive to talk about it. But Samsung Electronics Chairman Lee Kun-hee may order his top lieutenants not to sign a settlement or has simply accepted hawkish Apple strategies filed by top management,’’ said one Samsung official asking not to be named.

He claimed power intoxication in the booming mobile market is more important rather than selling more chips and flat-screens to Apple as Samsung has so far been successful in increasing its global share in smartphones and tablets since the court battle began.

Samsung started this trend last month after The Korea Times reported it would no longer be supplying Apple with LCD displays from next year, though it used several foreign media outlets to cool down the story.

Leading market research firm DisplaySearch released a statement that Samsung’s portion within Apple’s entire LCD buying for use in its iPads in October this year was a marginal 7.2 percent from 70 percent in March.

The world’s top component maker has also indicated that it will no longer supply Apple with batteries for their i-devices.

“Samsung’s top brass still thinks the firm’s is more than just a parts supplier. They want to be treated as a constructive and respectful business partner by Apple with the iPhone maker paying more of a premium in return for using Samsung parts,’’ said another company official by phone.

The Korean company has recently increased the price of the mobile application processors it manufacturers for Apple’s iOS devices. Apple had initially wanted to walk away but had no alternative supplier to take over manufacturing.

“I think it’s too much to say that Samsung and Apple have crossed the Rubicon. But the simple fact is Samsung has no plans to mend the souring ties with Apple for the time being. That’s why the company is heavily cutting off its supplies to Apple,’’ said a senior official from the Korea Intellectual Property Protection Association (KIPPA).

The current aggressive trend against Apple also contrasts the company’s previously-sought mild approaches earlier this year. At that time, Samsung said it was intended to closely partner Apple in components despite the legal proceedings.

“It’s true that one senior marketing executive who handled the Apple business was recently forced to move to the firm’s strategic planning office. This is another point that has justified Samsung’s changed stance towards Apple,’’ said the Samsung official.

Why no settlement?

Samsung officials said the ongoing legal battle will continue throughout next year. Its mobile chief Shin Jong-kyun recently confirmed it has no intention of seeking a settlement with Apple.

“What I can say is how the mobile device wars have dramatically changed the way that patents can be used by some large high-tech companies, namely from creating or reducing licensing cash-flows to maintaining or increasing market share in the hottest product markets,’’ said Ron Laurie, an advisor to the U.S. Patent and Trademark Office (USPTO), and the U.S. Copyright Office, in an email interview.

Laurie, who is the managing director at Inflexion Point Strategy LLC in Palo Alto, Calif. Continued, “The underlying premise being that a point or two in market share represents far greater economic return than any royalty stream.’’

Samsung agrees that there’s nothing to lose by continuing the fight with Apple.

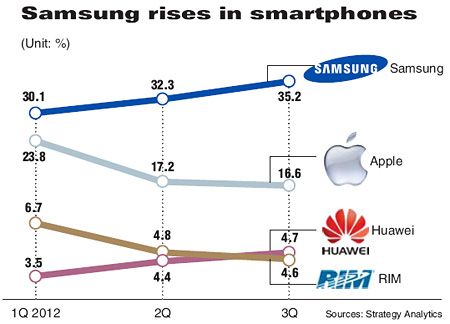

“Because we are becoming more powerful in the race for smartphones. Unlike Taiwan’s HTC, which recently signed a peace treaty with Apple, Samsung has more leverage as our global smartphone share is far higher than HTC’s. That means Samsung is better positioned to ask more from Apple in future negotiations,’’ said another Samsung official from its telecommunications division, requesting anonymity.

Changing situations for chip and flat-screen markets are also telling Samsung to take its time before heading to the negotiating table. Markets now favor suppliers to buyers as only a few players have survived the industry’s restructuring.

Years ago, there were more than 10 global chip and LCD suppliers, respectively. That means the suppliers had less power and had accept heavy price cuts by Apple as a contract with the California-based firm guaranteed better profit and revenue considering the popularity of its products.

Now, Samsung and LG Display are the top vendors of LCDs, followed by Taiwans’ Chi Mei Innolux. In chips, Samsung is also the leader, followed by SK hynix and two Japanese firms.

“We see another bullish year for smartphones and tablets in 2013. That means buyers need more components from suppliers that can guarantee on-time delivery, better pricing and output commitment. Samsung has undisputable leverage in the new trend in the global parts market as it is the biggest supplier both in chips and LCDs, which are crucial for use in Apple devices,’’ said Kium Securities senior analyst Kim Sung-in.

“Apple was the superpower that had been asking Korean parts suppliers to cut prices. But that’s the past. Because Samsung is impressive in its switch to smartphones and is strong in parts leadership, there’s no reason for the firm to go to the negotiating table right now,’’ said Hi Investment analyst Song Myeong-sup.

From a legal view, the reasons are different but patent experts have no big questions that the litigation will continue.

In a separate email interview, Brian J. Love from Santa Clara University School of Law stressed that the dispute may well continue for years to come as this issue is a very complex one.

“Settlement may be unlikely. Because patent litigation takes years to complete but companies like Samsung release new phones almost continuously, Apple can continue to file lawsuit after lawsuit, accusing each new batch of Android products as they are released for sale,’’ Love said.

According to his analysis, Apple wants recognition as the “one real innovator’’ in the smartphone market more than money and sales bans.

“I think Apple wants to send a message to the world that Apple made the smartphone as ubiquitous as it is today, and that Android is a mere copycat. Obviously, the accuracy of this message is questionable at best, but Apple executives appear to believe it and want to shout it from the rooftops.’’

U.S. Federal Judge Lucy Koh, who is presiding over the dispute, has confirmed that she will re-examine jury foreman Velvin Hogan’s alleged misconduct in an upcoming hearing on Dec. 6 at the San Jose court. Samsung is seeking a new trial as the firm believes Hogan was not qualified to be the foreman.

In August, nine U.S. jurors awarded Apple a $1.05 billion victory. But the jury found that one Samsung device didn’t infringe on Apple’s patents and yet they awarded Apple $2 million for inducement.

Then there was the confident statement from the retired engineer and patent holder Hogan. He reportedly told the court that the jurors had filled out all of the 700-question form without needing to read the jury instructions. Also, he was fired from Seagate Technology, one of Samsung’s strategic business partners. <The Korea Times/Kim Yoo-chul, Cho Mu-hyun>