From Political Changes to Economic Growth, from Wars to Disasters: Asia’s Defining Year 2025 (VI)

The year 2025 in Asia was shaped by impressive economic performances, historic turning points, lingering tensions between neighbors, high-stakes elections, waves of protest, the change of governments, cautious diplomatic breakthroughs among certain states, and relentless natural disasters with deep scars for peoples and countries.

THE AsiaN, founded on Asia Journalist Association’s network of journalists, is highlighting through articles written by its members the major issues that defined 2025 across Asia’s regions and countries. – Editor’s note”.

Sri Lanka’s Precarious Path to Recovery: Navigating Geopolitical Tides and Deep Structural Risks

By Leo Nirosha Darshan

News Editor at Express Newspapers, Sri Lanka

COLOMBO: Nearly four years after descending into its worst economic crisis since independence, Sri Lanka is engaged in a delicate -and often precarious- balancing act to secure its long-term stability. The nation’s recovery is not merely a domestic challenge but a high-stakes geopolitical arena, where the roles of regional giants -India and China- and emerging Middle Eastern investors are deeply intertwined with its fate.

While the immediate crisis has subsided, the journey ahead remains fraught with deep-seated structural risks that threaten to derail the progress made under the crucial International Monetary Fund (IMF) Extended Fund Facility (EFF).

The Geopolitical Tightrope: India, China, and the Gulf

Sri Lanka’s economic crisis exposed its vulnerabilities to external financing, transforming the island nation into a strategic flashpoint for competing regional interests. The restructuring of its external debt -a prerequisite for the IMF bailout- has forced Colombo to navigate the intricate and often conflicting demands of its primary creditors.

India’s response to Sri Lanka’s 2022 meltdown was swift, substantial, and highly strategic. Recognizing the political and security implications of a complete economic collapse on its doorstep, New Delhi stepped in with over $4 billion in emergency support. This included crucial lines of credit for essential imports such as fuel and medicine, currency swap agreements, and deferred loan repayments.

This support was instrumental in stabilizing the rupee and ensuring the basic flow of goods during the peak of civil unrest. India’s proactive stance significantly enhanced its goodwill and strategic footprint on the island.

Beyond emergency loans, Indian investment increasingly targets strategically significant sectors, particularly renewable energy projects in the northern and eastern provinces and logistics infrastructure- often seen as a counterbalance to China’s dominant role in Hambantota and Colombo. This deepening economic partnership is viewed as a foundational pillar of Sri Lanka’s immediate external stability and a strategic buffer against potential external shocks.

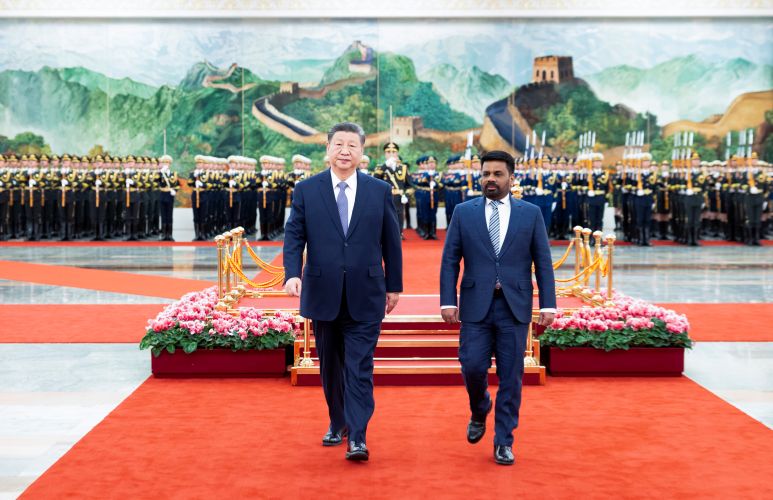

China: The Largest Creditor and the Debt Conundrum

China remains Sri Lanka’s largest bilateral creditor, and resolving its debt obligations continues to be the most politically sensitive and complex hurdle in the restructuring process. The terms of repayment and China’s approach to restructuring have been a focal point of global financial discussions, particularly concerning the transparency and speed required by multilateral institutions such as the IMF.

While Beijing has expressed support for Sri Lanka’s recovery and provided assurances to the IMF, the specifics of its debt treatment- whether through long-term extensions or significant haircuts- remain the subject of intense, closed-door negotiations.

The delays and opacity surrounding final agreements with the China Development Bank (CDB) and the Export-Import Bank of China (EXIM Bank) continue to create market uncertainty.

For Sri Lanka, striking a balance means securing favorable restructuring terms from China without jeopardizing its long-standing strategic relationship, which includes the operation of the Hambantota Port and development projects in the Colombo Port City. Political sensitivity is heightened by domestic critics who warn of the geopolitical implications of deep indebtedness to a single powerful actor.

The Gulf Countries: Emerging Investment and Energy Partners

A crucial -and relatively new- dynamic in Sri Lanka’s recovery is the emergence of Gulf countries, notably Qatar, the UAE, and Saudi Arabia, as significant potential investors. Unlike the geopolitical and debt-related complexities surrounding India and China, the Gulf states are primarily focused on commercial, high-return opportunities in sectors such as energy and logistics.

Their interest aligns with Sri Lanka’s strategic location along major shipping lanes and its untapped potential in renewable energy. Investment is being channeled into developing the country’s liquefied natural gas (LNG) infrastructure, diversifying its energy mix, and modernizing port operations.

These partnerships offer Sri Lanka a much-needed diversification of its investment base, moving beyond traditional reliance on East Asian or Western capital. Crucially, Gulf involvement provides foreign direct investment (FDI) that is less directly tied to the politics of debt restructuring, offering a purely commercial boost to economic growth.

Deep-Seated Structural Risks: The Internal Challenge

While external support is essential for survival, the long-term health of the Sri Lankan economy depends on overcoming entrenched internal structural flaws. The IMF programme mandates rigorous reforms, but implementing them remains challenging amid political headwinds and social distress.

Persistently High Debt and Fiscal StrainDespite ongoing restructuring efforts, Sri Lanka continues to grapple with a high debt-to-GDP ratio, currently above 100%. Even with successful restructuring, the ratio is expected to remain elevated for the foreseeable future.

This constrains the government’s fiscal space, diverting a disproportionate share of national revenue toward debt servicing and away from crucial social and development spending. Maintaining primary fiscal surpluses -a core IMF requirement- will demand sustained political commitment to tax reform and spending restraint, a difficult task in a pre-election environment.

Slow Progress in State-Owned Enterprise (SOE) Reform

A critical drag on the national economy has been the massive losses incurred by key State-Owned Enterprises (SOEs), particularly SriLankan Airlines, the Ceylon Petroleum Corporation (CPC), and the Ceylon Electricity Board (CEB). SOE reform -restructuring, cost-cutting, and eventual divestiture or Public-Private Partnerships (PPP)- is central to the IMF programme.

However, progress has been slow. Resistance from powerful trade unions and vested political interests continues to impede privatization efforts. Failure to reform SOEs will necessitate continuous Treasury bailouts, undermining fiscal discipline and the credibility of the entire reform agenda.

Socio-Political Instability: The Cost of Living

The economic stabilization achieved through the IMF programme has come at a significant cost to the average citizen. High taxes, increased utility tariffs, and the cumulative effects of currency depreciation have driven up the cost of living and strained household budgets.

While inflation has moderated from its peak, real economic hardship persists and is fueling social discontent. Sustained pressure on living standards could trigger political unrest, jeopardizing the stability needed for policy implementation and providing fertile ground for populist movements promising swift -but unsustainable- relief.

Exposure to Global Commodity Shocks

Sri Lanka remains highly vulnerable to global commodity price fluctuations, particularly for oil and fertilizer. The crisis was worsened by the surge in post-2022 global energy prices, compounded by the government’s ill-conceived domestic fertilizer policy that crippled the agricultural sector. The nation’s energy security remains fragile, and any future spike in oil prices driven by geopolitical instability -such as in the Middle East-could severely impact its import bill, foreign reserves, and inflation trajectory, undermining recent gains in macroeconomic stability.

Dependence on External Income Streams

Reliance on two major external income streams- tourism and remittances- poses structural vulnerabilities. While both sectors have recently shown strong recovery, they remain highly sensitive to global economic conditions and security developments. A global recession could reduce remittances from the Gulf and Western nations, while any regional security incident could devastate tourism. Diversifying export earnings and increasing FDI in non-traditional sectors are essential for building long-term resilience, but progress remains gradual.

Climate Risks and Economic Fragility

Sri Lanka also faces significant climate-related risks. The recent ‘Diwtha’ cyclone, which intensified political scrutiny over disaster management, highlighted the vulnerability of the island’s infrastructure and agriculture to extreme weather events. Frequent floods and droughts threaten agricultural output, strain water resources, and necessitate recurring infrastructure repairs -placing unpredictable burdens on the national budget and potentially undermining development goals. Integrating climate resilience into national planning is no longer an environmental luxury but an economic necessity.

Conclusion: A Reprieve, Not a Recovery

Sri Lanka has secured a reprieve, not a recovery. Its economic trajectory now depends on its ability to navigate the competing geopolitical interests of India and China, attract new investment from the Gulf, and, most critically, deliver the painful but necessary domestic structural reforms. The global community -particularly multilateral institutions- must recognize that failure to stabilize Sri Lanka would represent not only a setback for the island nation but also for regional stability and the broader debt-resolution framework in the Global South. The next two years of reform implementation will determine whether the country can shed its century-long economic vulnerabilities and achieve genuine, lasting prosperity.