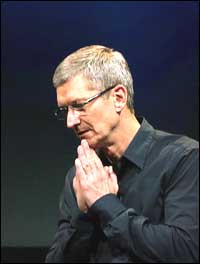

Cook doesn’t have Job’s magic

Apple CEO Tim Cook may be having sleepless nights nowadays, with data indicating that the U.S. technology giant has started losing its innovative and premium image over rivals such as Samsung Electronics.

The Cupertino-based firm has recently been hit by the double whammy of sluggish sales of the iPhone 5 and a drop in its stock price. As a result, its market share is stumbling.

According to Hong Kong-based Counterpoint Technology Market Research, Friday, Apple’s share fell by 3 percentage points to 16 percent in December from the previous month. Samsung Electronics retained the top with a 29 percent share for the second consecutive month.

A majority of brokerages and market agencies forecast that Apple would sell over 50 million iPhone 5s prior to its launch but they have adjusted their prediction to as low as 25 million.

The bleak sales expectation caused its stock prices to plummet. Apple stocks had plunged 28 percent to $485.92 on Jan. 15 from a record high of over $700 in September, last year.

Apple’s setback in premium image came as a result of the iPhone 5’s lack of innovative features, and alleged problems in CEO Cook’s leadership and supply chain management.

The CEO was never really praised as an innovator but he had been known as an astute manager who streamlined businesses well. “Tim Cook is known to excel in supply chain management, at creating efficient business structures and securing margins,” said an executive of a local parts supplier to the electronics manufacturer.

The recent production problems vocally stated by Chinese partners Foxconn, however, indicates that the iPhone maker’s relationship with its partners maybe turning sour. Local industry analysts say components makers and manufacturers also dislike Apple’s price controlling power that it enjoyed using its hegemony.

Now part suppliers no longer need to concede to its demands in prices as there are more valuable options, especially emerging Chinese technology giants such as ZTE and Huaweii. The iPhone maker’s leverage against its partners has decreased by both the expansion of competitors and its lower sales.

In order to defend its declining market share, the company is speculated to be preparing a low-end, affordable version of the iPhone for emerging markets, especially China, at the cost of its premium image.

Releasing budget-phones that will inevitably narrow its bottom line is worth it in the interest of defending its market share, said analysts.

“To protect its market share, Apple will likely release a low-end iPhone and increase its product variety to three or four per year,” said Seoul-based analyst Thomas Kang. “Apple up to now maintained margin of 40 percent of its revenue but is willing to lower that by 30 percent to protect its share,”

Last year, the release of the iPad mini signified that Apple was taking the competition from affordable 7-inch range products released by Amazon and Google seriously. Though the smaller iPad is priced higher than competing products from rivals, it is much cheaper than Apple’s own previous releases.

Rival Samsung, since its debut in the smartphone sector in 2010, always adjusted its strategy to compete against Apple by doing what it does best: manufacturing massively. For its flagship series Galaxy S it continues to make spinoffs such as the Galaxy S III mini and the Galaxy S II Plus among others.

A recent report by Fitch Ratings said that compared to Apple, Samsung commands a greater geographical exposure, particularly in emerging markets where pre-paid plans are the norm and many people cannot afford high-end phones.

“Samsung’s status as the undisputed leader for several key smartphone components _ including displays, processors and memory chips _ reinforces the likelihood that its future smartphone models will be equipped with cutting-edge technology,” said Fitch’s report.

The main result of this is that it is its own largest purchaser from group affiliates such as Samsung SDI. It suffers no possible delay in shipping its phones like Apple.

“The business model of Apple was the one others attempted to emulate, but now it needs to reorganize to follow fast rising competitors,” said an industry official, who preferred not to be named. <The Korea Times/Cho Mu-hyun>