Strong won hurts carmakers, IT firms, shipbuilders

Concerns are growing over the ill-effects of the local currency’s steep appreciation against the dollar as the stronger won makes Korean products more expensive on the global market. This also results in smaller earnings in terms of won for exporters, which affects their profitability.

The won-dollar rate hit a new yearly low Thursday closing at 1,073 won, down from 1,075 won the previous day’s trading, as the U.S. Federal Reserve introduced new stimulus measures. The won-dollar rate was the lowest since Sept. 7 2011 when it was 1,071.8.

Although local exporters have become less vulnerable to changes in the won-dollar rate than in the past, semiconductors, auto, information technology, refinery and other export-oriented industries continue to be weighed down by the won’s ascent against the greenback and other foreign currencies.

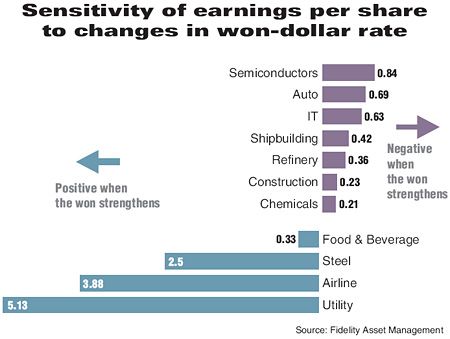

According to Fidelity Asset Management, Wednesday, the sensitivity of earnings per share (EPS) to the foreign exchange rate among exporters was estimated at 0.84 for semiconductor firms, followed by carmakers at 0.69, information technology businesses at 0.63, shipbuilders at 0.42, refiners at 0.36, construction companies at 0.23 and chemical firmss at 0.21.

The sensitivity of 0.84 means that if the won strengthens against the dollar by 1 percent, net profits of semiconductor makers decline by 0.84 percent as their products become more expensive abroad.

In contrast, among industries benefiting from the strengthening of the local currency, the EPS sensitivity to the rate for utility companies was 5.13, 3.88 for airlines, 2.5 for steelmakers and 0.33 for food and beverage firms.

If the won gains ground against the greenback by 1 percent, the net profits of utility firms rose by 5.13 percent thanks largely to lower import costs of raw materials.

Fidelity said even though the extent of the negative effects on exporters as a result of the won’s rise has weakened over the years, it continues to make it more difficult for local firms to generate profits from shipping their products overseas.

“Korean exporters can now better cope with foreign exchange risks than in the past. Some of them have established substantial production bases abroad, while others built up an effective currency risk management system,’’ said Kyobo Securities analyst Kim Hyung-ryoul.

“But still, makers of semiconductors, automobiles and information technology gadgets are negatively affected as they engage in fierce competition with Chinese and Japanese rivals on the global markets,” he said.

However, utility companies, airlines, steelmakers and other industries that import crude oil and other raw materials benefit substantially from the strengthening of the won because they pay less for imported commodities, he said.

“The won’s recent ascent has largely been driven by outside factors. Korea’s outbound shipments have remained stagnant. Foreign investors have not brought huge funds into the country to purchase local stocks and bonds,’’ the analyst said. “The falling won-dollar rate is mainly due to expansionary monetary policies adopted by the United States, Europe and Japan, as well as Korea’s improved sovereign credit ratings and its relatively high interest rates.’’

Kim projected that the won-dollar rate will hover around 1,080 this month. “The rate has dropped below 1,080 won this week. The problem is that the pace of the won’s strength has been too steep. But we expect that the won will weaken a bit against the greenback toward the year’s end, pushing the rate back over 1,080.’’

According to a recent survey of 500 local exporters conducted by the Korea Chamber of Commerce and Industry, the average breakeven won-dollar rate for Korea Inc. was estimated at 1,086.2. This means if the rate drops below 1,086 won, companies do not earn profits from shipping and selling products overseas.

The breakeven exchange rate for large companies was estimated at 1,076 won, while small– and medium-sized enterprises lose money if the rate falls below 1,090 won. <The Korea Times/Lee Hyo-sik>