Markets unlikely to be swayed by election

With the presidential election over, policymakers and investors are looking to how the results will affect the future course of financial markets, particularly the stock market.

Analysts predict the stock market will receive a short-term boost on the elimination of political uncertainty and the anticipation of stimulative economic policies by the new administration.

But the impact will be limited and short-lived as external factors such as economic conditions in the U.S. and Europe and their economic policies play a more important role, they said. U.S. fiscal problems, Japan’s credit-easing policies and lingering woes in Europe are downside risks for the domestic markets.

“Given past patterns, the KOSPI has jumped in the first year after all presidential inaugurations except for President Lee Myung-bak,” said Korea Investment & Securities analyst Lee Da-seul. “But now we have more critical external factors that will have a bigger impact on our economy such as the U.S. fiscal cliff and China’s new leadership.”

Ahead of the election, the benchmark Korea Composite Stock Price Index (KOSPI) closed at 2,002.77 on Dec. 13, passing 2,000 points for the first time since Sept. 24, when it ended at 2003.44. It closed at 1,993.09 on Tuesday.

“Although the election is expected to have an adverse impact on conglomerates and retail businesses, shares related to welfare policies are expected to grow,” said an analyst at Hana Daetoo Securities.

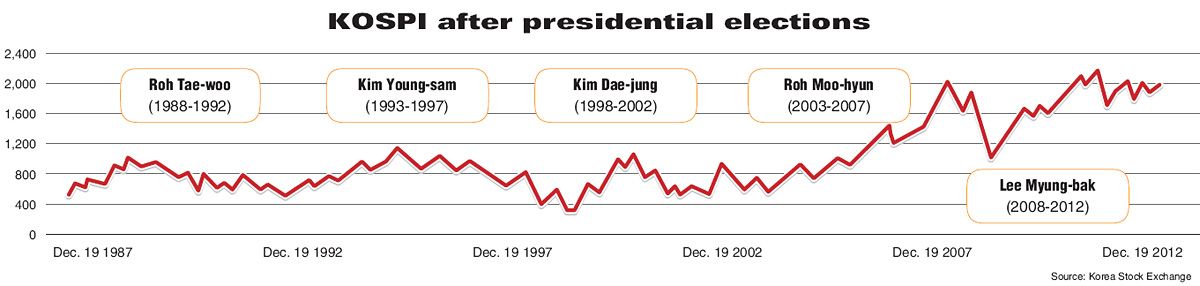

Past elections and market movement

After the nation implemented a direct election system in 1987, the results of the first three presidential polls led to big returns in the stock market.

For the two months after Roh Tae-woo, Kim Young-sam and Kim Dae-jung were voted in and before they were officially inaugurated, the benchmark KOSPI index rose 39.1 percent, 1.85 percent and 29.25 percent respectively

The Roh administration took advantage of three major favorable economic conditions ― low oil prices, a weakened Korean won and low interest rates ― as well as the nation’s hosting of the 1988 Seoul Olympic Games. In the first year after his inauguration, the KOSPI jumped 92.13 percent.

When Kim Young-sam took office in 1993, his administration implemented various policies to boost the stock market, which helped the KOSPI jump 31.12 percent in his first year in office.

But he bore the stigma of having led an administration that brought on the nation’s worst economic crisis and sought a bailout from the International Monetary Fund. The crisis caused big banks and large conglomerates to close and sparked massive layoffs.

After the failure of his predecessor, Kim Dae-jung carried the anticipation that the Korean economy would bounce back, with the KOSPI rising 34.40 percent in his first year, despite the big hurdles in the economy.

“In our single-term system, newly-elected presidents tend to aggressively expand the budget,” Woori Securities analyst Kang Hyun-chul said. “So February and March are good times to buy stocks.”

External factors matter

But since the dawn of the new millennium, election results have had less impact on the stock market than global risk factors.

The KOSPI plunged 13.1 percent in the first two months after Roh Moo-hyun was elected in 2002, with growing concerns over the possibility of a U.S. invasion of Iraq. It regained 14.3 percent in his first year.

The stock market also experienced huge turmoil in 2008 around the time when the Lee administration was launched due to the subprime mortgage crisis in the U.S.

The KOSPI dropped 9.4 percent in the months after the election before Lee took office and plunged 39.59 percent in his first year, although he vowed to boost the benchmark to 2,000 mark as an election pledge.

“The stock market has shown a different pattern in the first two months before a president-elect is inaugurated since the 1997-1998 financial crisis and the beginning of the new millennium,” said Wi Moon-bok, an analyst at Hana-Daetoo Securities. “It is largely because of the growing presence of foreign investors here, I think.”

Lee introduced a range of stimulative policies favorable to conglomerates with the aim to boost economic growth to 7 percent and raise the country’s per capita income to $40,000 but they did not work well in the face of unfavorable global economic conditions such as financial crises in the U.S. and Europe. <The Korea Times/Kim Tae-jong>