V-Society

How fraternity impacts business, politics

Not many people knew about V-Society. Since its foundation in 2000 the fraternity of domestic business leaders and entrepreneurs has formed an extensive network of power, prosperity and position.

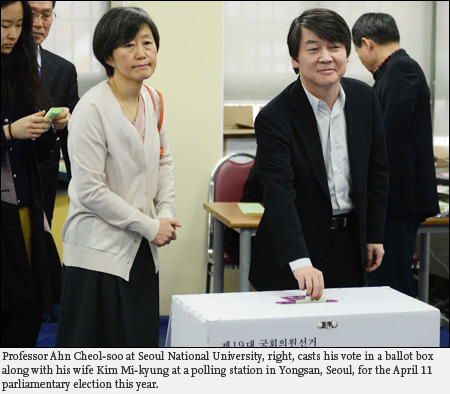

Recently it was suddenly mentioned in the media and the trigger was Ahn Cheol-soo, a Seoul National University professor, who is speculated to be a potential candidate and likely winner in the Dec. 19 presidential election.

Now everybody wants to know whether V-Society is a secret pact of ultra-rich tycoons or just a high-society socializing club. “V” denotes “Venture.”

It was recently reported that Ahn joined the campaign to save the troubled SK Group Chairman Chey Tae-won in 2003. Ahn signed the petition for Chey, the founder of V-Society and a pivotal player in the society’s operation.

Among the high-profile members of the weekly meeting are Lotte Group Chairman Shin Dong-bin, Kolon Chairman Lee Woong-yeul, Hyundai Development Company Chairman Chung Mong-gyu and Shinsegae Vice Chairman Chung Yong-jin.

Aside from Ahn, who headed the country’s No. 1 anti-virus program developer AhnLab, other promising venture start-up leaders took part such as Humax CEO Byun Dae-gyu, Daum Communications founder and former CEO Lee Jae-woong and Jusung Engineering CEO Hwang Chul-joo.

Being a member didn’t help Ahn, who has iterated the importance of shareholders’ interest ahead of those of business leaders, but it put V-Society in the headlines.

Rumors swirled that it was an exclusive club of wealthy tycoons and successful entrepreneurs who have to pay up to 200 million won per year to maintain their membership.

In addition, V-Society’s unrealized scheme of establishing online-based banking, dubbed V-Bank, prompted some conservative media to lash out at what they deemed to be Ahn’s dual standards.

Their rationale: V-Bank is against the official views of Ahn, who has strongly supported the separation of industry and finance since V-Bank was intended to be a lender set up by industrial capital.

To top other things off, Ahn’s relationship with SK Chairman Chey has been a particularly thorny issue for the former and some even contend that the link between them was stronger than reported.

“Ahn and Chey co-founded IA Security in July 2000 and Ahn maintained the stewardship at the corporation through April 2003 even after Ahn petitioned for the reduction of Chey’s jail term,’’ said Rep. Cho Won-jin from the governing Saenuri Party.

More suspicions

Many aspects of V-Society remain unknown due to its exclusive membership and are shrouded by a swirl of rumors. This ends up hurting Ahn who was admired by the public for having strong integrity and morality.

In the latest round of reports, suspicions sprang up that Ahn used his wife’s name to invest in V-Society. Ahn’s wife Kim Mi-kyung, also a professor at Seoul National University, maintained a 3.88 percent stake in V-Society.

In response, Ahn’s spokesman Yu Min-yeong said that the rumors on Ahn and V-Society are totally groundless.

He said that V-Society is an incorporated firm whose 21 major shareholders funneled 200 million won each as a one-off investment for a total capital fund of 4.2 billion won. This contradicts the notion that 200 million won is the yearly membership fee.

“In 2000, Ahn resorted to loans to expand AhnLab. As it was difficult for him to borrow more funds, his wife channeled the necessary 200 million won investment for V-Society. That’s why Kim, not Ahn, holds the share,’’ Yu said.

“And the investments have already been recouped midway through last year when V-Society decreased its capital. Subsequently, Ahn is not associated with V-Society anymore.’’

Yu said that Ahn’s collaboration with Chey for IA Security was just one of many partnerships as Ahn’s company is a security specialist ― it is a feature indispensable for all corporations.

Kim Hyung-jin, who worked for V-Society for about three years after the club’s foundation, also rebuffed rumors concerning Ahn in a recent posting on Facebook, especially with regard to V-Bank.

The gist: “Back in the early 2000s, there was a venture boom, which caught the interest of conglomerate owners by surprise. They vied to cooperate with venture entrepreneurs to come up with business models beneficial for both sides.’’

“V-Bank was an idea suggested as one way to realize win-win ideas for both conglomerates and start-ups. At the time, online-based brokerages began to appear. So, online-specific banks seemed plausible at the time although the scheme was eventually jettisoned due to regulations.’’

His remarks undermined Ahn critics, who iterate that V-Bank attests Ahn’s dual standards, that his track record does not live up to his proclaimed principles on the separation of industry and finance.

When contacted, Kim refused to comment further. After leaving V-Society, he worked for JPMorgan Chase and IBK Investment Securities and of late is active in the camp of opposition Democratic United Party’s leading presidential candidate Moon Jae-in.

However, Ahn cannot deny his involvement in the 2003 petition for Chey, who was sentenced to a three-year prison term. The businessman-turned-professor has acknowledged and expressed regret regarding the issue as soon as the media exposed it late last month.

He particularly lost ground because, in his recent book, Ahn fired a salvo at the judiciary’s customary lenient measures toward chaebol chiefs.

On his post, Kim countered that one cannot jump to the conclusion that Ahn is a two-faced politician.

“Chey was the centerpiece in establishing and operating V-Society. Accordingly, when Chey was imprisoned, V-Society members felt that it was the right thing to do by signing a petition for him,’’ he noted on Facebook.

“It does not add up that Ahn sought only personal interests with the signing. In fact, the fortunes of SK and Chey were uncertain in 2003. Ahn would have been better off not signing the petition for his own interests.’’

Economic ripple effects

Whatever the truth is, the controversies over V-Society have already marred the morality of Ahn who is equivocal about the possibility of his running for the next presidency.

The impact of the V-Society dispute not only affects politics but also economic facets, according to domestic consultancy Chaebul.com.

The stock value of 20 V-Society members totaled 6.46 trillion won as of the end of last month before reports of Ahn’s signing the petition for SK Chairman Chey but they jumped by 5.9 percent to 6.84 trillion won during the first 10 days of August, surpassing the market average of 3.5 percent.

That of Ahn also rose by 4.3 percent from 336.6 billion won on July 31 to 351.2 billion won on August 10.

Up to 17 of the 20 gained with the exception of just three including Daum founder Lee Jae-woong and Jusung CEO Hwang Chul-joo. No tycoons saw deficits in their stock accounts during the 10-day period.

“The additional increase of 2.4 percentage points represents investors’ expectations that companies related to V-Society will gain if Ahn enters and wins the presidential election,’’ said a Seoul analyst who asked not to be named.

“The 2.4 percentage point uptick has nothing to do with any market fundamentals of the associated corporations. It’s like AhnLab’s high-flying share prices regardless of its market values.’’

The market capitalization of AhnLab moved in the neighborhood of 200 billion won throughout the first half of last year but the figure rocketed last summer when Ahn emerged as a solid but yet uncertain presidential hopeful.

Currently, its market capitalization is well above the 1 trillion won mark with its price-earnings ratio (PER) topping 70, which means that its current share price is 70 times more than its per-share earnings a year.

Over the first decade of the new millennium, the Seoul bourse’s average PER was 11.8 and before Ahn’s surge on politics, that of AhnLab was also in the vicinity of the long-term average but in the last year it has soared to extraordinary levels. <The Korea Times/Kim Tae-gyu>