3-way battle

KB, AIA, Manulife to vie for ING’s Korean unit

The contest to buy ING Group’s Korean insurance unit has turned into a three-way battle as Canada’s Manulife Financial is expected to join the main bidding scheduled for July 16.

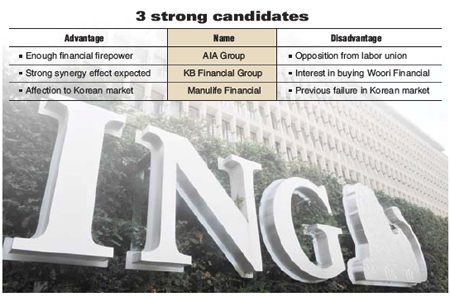

KB Financial Group and Hong Kong’s AIA Group were considered the only main candidates after they made the shortlist for preferred bidders.

Analysts said Manulife was previously known to only be interested in ING Group’s operations in Hong Kong and Malaysia but has started to eye up the Korean branch.

“The competition seems to be getting fiercer, as Manulife shows a strong interest in the Korean operation,” Lee Chul-ho, analyst at Korea Investment and Securities said.

As an unexpected bidder for the Korean operation of the Dutch insurer, Lee said it seems the Canadian insurer has been long considering making a comeback to the Korean market.

“It seems Manulife wants to come back here, after it showed interest in buying Korean insurers such as the Korea Life Insurance and Tongyang Life Insurance,” Lee said.

Manulife established Youngpoong Life Insurance as a joint venture in 1989 but sold it to U.S. life insurer Prudential Financial in 1999 during the Asian financial crisis.

Since then, it has sought an opportunity to re-enter the market. It has operated for 115 years in Asia through joint ventures, acquisitions and by expanding its teams of agents and brokers.

Although detailed conditions for the takeover have not been announced, the group is expected to divest investment management operations separately instead of selling its Asian interests all together.

Some market insiders said it is also possible for Manulife to purchase the entire Asian unit. ING Group’s Asia-Pacific insurance arm consists of regional branches in Korea, Japan, Malaysia, Hong Kong, China, Thailand and India.

With the new player joining the contest, KB Financial Group and AIA may see the situation as less favorable.

KB Financial Group Chairman Euh Yoon-dae has openly expressed interest in the acquisition of ING’s Korean unit and was believed to enjoy advantages from a close relationship with ING Group.

As the third-largest shareholder of KB Financial with a 5.02 percent stake, and market insiders believe ING can maximize returns from its investment if it sells the Korean unit to KB Financial because it will cause KB Financial shares to rise.

It’s not as simple as that though. KB seems to be in a dilemma because the group is also interested in a merger with Woori Financial Group. It may lack the ability to acquire ING Korea and the nation’s top financial group at the same time. It is estimated that the Korean insurance unit is priced at over 3 trillion won.

In terms of budget, AIA seems to have more financial firepower than its competitors. As of last November, it had $4.3 billion in cash.

It has also shown strong interest as AIA believes the acquisition would have a synergy effect on its business in Korea, catapulting its ranking to fourth from 10th here.

“The acquisition will allow us to secure the No. 4 position, and maximize synergy as ING and AIA have different strengths,” an official from AIA Korea told The Korea Times.

But AIA Korea is finding the opposition of ING Korea’s labor union to the sale a heavy burden, because the acquisition will involve massive restructuring.

The labor union has announced it will soon go on strike to seek job security after the acquisition.

Some market insiders said the sale of the ING’s Asian units could be delayed due to unfavorable conditions. Big global and local financial groups and insurers have intensified the competition for what would be the biggest insurance industry transaction of its kind in Asia.

“The sale could be delayed as bidders and ING are taking a very careful stance,” a market insider with knowledge on the matter said. “People are saying bidders have proposed prices lower than ING first expected, and ING has no reason to rush at the moment.”

ING’s insurance operations have been on the market for a while as the firm has to divest its Asian insurance business, worth $6 billion, by 2013 in order to receive state bailout funds after being badly impacted by the eurozone debt crisis. <The Korea Times/Kim Tae-jong>