Old habits die hard

Despite housing slump, rich still bet on real estate

The property market is in dire need of a boost, but wealthier Koreans keep the faith that there will be another huge payoff with a stubborn commitment to real estate. Not that they can afford to second-guess when real estate continues to account for the majority of their wealth.

A KB Financial Group survey of 400 “rich’’ Koreans, the cut-off line drawn at a minimum 1 billion won (about $880,000) in financial assets, showed that real estate remains their most preferred investment target as it garnered 30 percent of the votes. However, their enthusiasm has subdued considerably from last year, when 45 percent of the respondents picked property as their top choice.

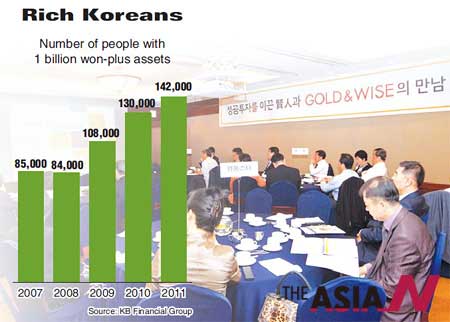

The number of people classified as rich numbered 142,000 individuals at the end of last year, a significant increase from 84,000 at the end of 2008 when the pain from the Lehman Brothers collapse was still fresh, according to the report by KB’s in-house think tank.

The country has since been reeling from a sharp pullback in economic activity, a decaying job market and a meteoric rise in personal indebtedness, but the jump in the number of rich people proves once again that one man’s debt is another man’s savings and widening the gulf between them.

Rich Koreans each owned around 14.4 billion won in assets last year. Property accounted for around 58 percent of their wealth and financial assets, 35 percent. Miscellaneous assets, like top-drawer artwork or country club memberships, accounted for 6.8 percent.

There were 130,000 Koreans with 1 billion won-plus in assets in 2010 and 108,000 in 2009.

“The 142,000 rich Koreans counted at the end of 2011 represented an 8.9 percent annual increase. The number of rich people increased annually by around 20 percent since 2008, and it appears that last year’s slowdown can be explained by financial market volatility owing to the escalating financial crisis in Europe and the housing market slump,’’ said KB researcher Noh Hyeon-gon, one of the report’s authors.

“Our data showed that the proportion of real-estate assets gets increasingly larger toward the upper-end of the wealth spectrum. The proportion will become smaller and financial assets become larger among those lower in the asset-size totem pole. This shows that most rich Koreans will cap their financial investments at a certain level and use the rest of their resources on property.

“In a real estate investment, rich people are increasingly looking toward the rent market in commercial buildings and office units, preferring a consistent source of income rather than attempting to make a killing on buying low on properties and selling them high, as this is not the right environment for such moves.’’

Wealthy households with two members or more earned an average of 412 million won in annual income last year, nearly nine times that of the urban household average of 47 million won, based on KB’s analysis of Statistics Korea data.

Rich families got about 37 percent of their income through interest, dividends, rent and other forms of property income, compared to the average household, which depended on wages for more than 87 percent of its income.

More than 68,000 of rich Koreans lived in Seoul last year, accounting for 47.9 percent, representing a decline from 49.6 percent in 2009. About 26,000 of the rich people in Seoul lived in the affluent southern districts of Gangnam, Seocho and Songpa. <The Korea Times/Kim Tong-hyung>